LBOs have become very attractive as they usually represent a win-win situation for the financial sponsor and the banks: The financial sponsor can increase the returns on his equity by employing the leverage; banks can make substantially higher margins when supporting the financing of LBOs as compared to usual corporate lending, because the interest chargeable is that much higher.

The amount of debt banks are willing to provide to support an LBO varies greatly and depends, among other things, on:

The quality of the asset to be acquired (stability of cash flows, history, growth prospects, hard assets, …)

The amount of equity supplied by the financial sponsor

The history and experience of the financial sponsor

The economic environment

For companies with very stable and secured cash flows (e.g., real estate portfolios with rental income secured with long term rental agreements), debt volumes of up to 100% of the purchase price have been provided. In situations of "normal" companies with normal business risks, debt of 40–60% of the purchase price are normal figures. The debt ratios that are possible vary also significantly between the regions and between the industries of the target.

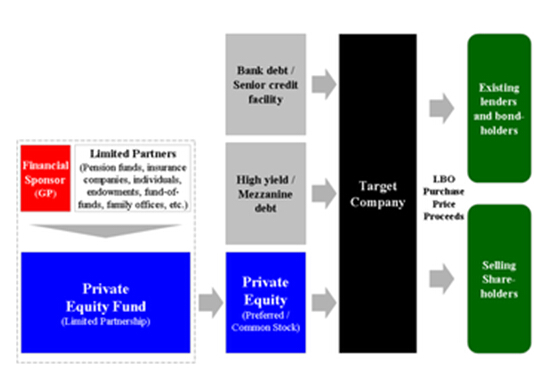

Depending on the size and purchase price of the acquisition, the debt is provided in different tranches.

Senior debt: This debt is secured with the assets of the target company and has the lowest interest margins

Junior debt (usually mezzanine): This debt usually has no securities and bears thus a higher interest margins

In larger transactions, sometimes all or part of these two debt types is replaced by high yield bonds. Depending on the size of the acquisition, debt as well as equity can be provided by more than one party. In larger transactions, debt is often syndicated, meaning that the bank who arranges the credit sells all or part of the debt in pieces to other banks in an attempt to diversify and hence reduce its risk. Another form of debt that is used in LBOs are seller notes (or vendor loans) in which the seller effectively uses parts of the proceeds of the sale to grant a loan to the purchaser. Such seller notes are often employed in management buyouts or in situations with very restrictive bank financing environments. Note that in close to all cases of LBOs, the only collateralization available for the debt are the assets and cash flows of the company. The financial sponsor can treat their investment as common equity or preferred equity among other types of securities. Preferred equity can pay a dividend and has payment preferences to common equity.

As a rule of thumb, senior debt usually has interest margins of 3–5% (on top of Libor or Euribor) and needs to be paid back over a period of 5–7 years, junior debt has margins of 7–16%, and needs to be paid back in one payment (as bullet) after 7–10 years. Junior debt often additionally has warrants and its interest is often all or partly of PIK nature.