1.The funds raised , mainly through a small number of non-public way for institutional investors or individuals to raise its sales and redemption of all fund managers and investors through private negotiations conducted . Also in the way they invest in private form , rarely involved in open market operations, generally do not need to disclose details of the transaction .

2.Take a more equity -type investment, debt investments rarely involved . PE investment institutions have therefore been invested enterprise decision management enjoys a certain vote. Reflected in the investment vehicles , the use of ordinary shares or preference shares can be transferred , as well as tools in the form of convertible bonds .

3.Unlisted equity investment company , or invest in non- publicly traded shares of listed companies , due to poor mobility is regarded as long-term investments ( generally up to three years to five years or longer ) , so investors will require higher than the open market return.

4.Extensive funding sources, such as wealthy individuals , venture capital, leveraged buyout funds, strategic investors , pension funds, insurance companies and so on.

5.No publicly traded , so there is no ready market for unlisted companies transferring equity deal directly with buyers . While holding money needs to be invested investors and investment companies must rely on personal relationships , trade associations or intermediary to find each other.

6. Compare tend to have a certain size and shape to generate stable cash flow business , which is a clear distinction with the VC .

7.There are three main methods of return on investment : public offering , sale or merger , reorganization of the company's capital structure . For foreign capital companies, private equity investment is not only a long period , an increase of capital and other benefits , but also can provide a management, technology , marketing and other needed expertise. Fluctuations relative to the open market is difficult to predict in terms of private equity capital markets are more stable sources of financing. The introduction of private equity investment in the process , you can competitor confidential because disclosure of information is limited to investors without having to be made public so as to market.

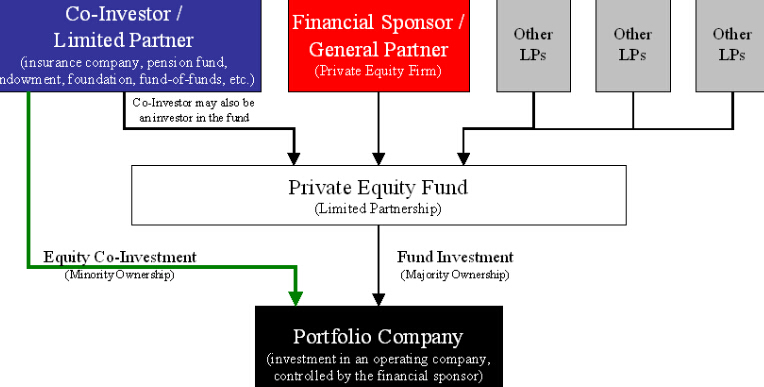

8.PE investment institutions to take a more limited partnership , this form of business organization has a very good investment management efficiency , and to avoid the double taxation of the state.

9.Exit diversified investment channels , there is an initial public offering IPO, sold (TradeSale), mergers and acquisitions (M & A), the target company's management repurchase .