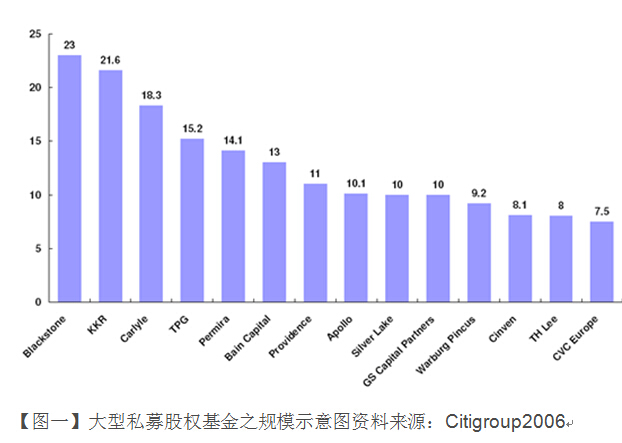

Since the 1990s, LBO mergers and acquisitions along with the highly leveraged instruments and low interest rate environment and the popular, private equity funds and hedge funds and even has become the core of global capitalism. The famous private equity fund management companies, including KKR, Blackstone Group, Carlyle Group, Texas Pacific Group (TPG) and other fund-raising success in recent years in the world, and even has started to form a so-called giant Fund (Mega Fund), that is, single file size of more than 100 funds more than one hundred million U.S. dollars (see [Figure A]).

A schematic diagram [Source] large-scale private equity funds: Citigroup2006

If the maturity from global private equity funds (see [Figure II]) view, Africa, Asia and Europe, the emerging market economies of emerging market economies is only in its infancy, all the conditions are poor; Asian developing economies are in the development stage, business owners educated and attractive investment opportunities in the two excellent, but the open market exit, information disclosure and due diligence (due diligence) the standard is very weak; robust period in Western Europe, most of the development Conditions are good; regards the development of private equity funds in the United Kingdom and the United States the most mature.

Secondly, in 2006 the global investment ranking (Refer to Table A]) to be observed before the top 20 global investment, the United States and Europe accounted for ten, including seven of the top ten European countries are more visible Global private equity fund of funds investment focus to Europe and other countries are still ripe for the development of private equity fund investments as the main focus. It is worth noting however, Asian emerging markets in recent years, the rapid rise in the rankings that six Asian countries, the region in terms of investment, after the United States and Europe are in hot pursuit, and the Chinese mainland, Japan, Singapore and other countries and more crowded Investment ranked in the top ten, won many European countries, seen in recent years, private equity funds for emerging Asian countries favor.

On private equity funds on the global layout, Europe and other private equity funds still have been mainly developed countries, including the United States, Britain, Canada, France, Germany, the Netherlands, Spain and the Nordic countries. And the layout of the countries outside Europe, then the Asian emerging markets, including China, Japan, Korea, India and Australia, the Australian-based (see Chart 3). In addition to other nations addressed before opening the outside, yet to see the layout of private equity funds active, and only sporadic small amount of capital investment.