Foreign Investment

American.gov | 2013-01-24 14:07

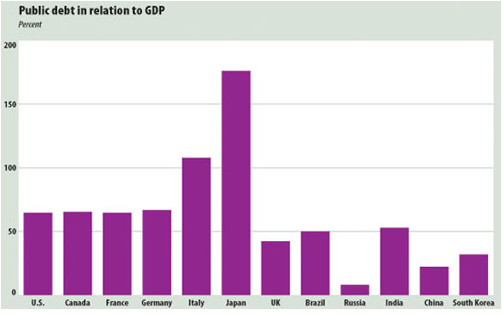

The ratio of public debt to economic output is higher than in many but not all countries.

Foreign investors seek opportunity in the U.S.

(The following article is taken from the U.S. Department of State publication, USA Economy in Brief.)

Some economists identify as another serious challenge the dependence of the U.S. economy on inflows of foreign capital for investment in a situation of low U.S. savings rates.

Even as the United States has prospered, its workers have built high and rising levels of household debt. By official statistics, what was a tiny but positive savings rate has turned negative in some years since 2000. For the first time since the 1930s' Great Depression, households overall are actually spending more than they earn in after-tax income.

At the same time, the federal government has been running budget deficits – $435 billion in 2006 – much of it financed by foreign central banks. U.S. federal public debt, approaching $9 trillion, is estimated at about 65 percent of GDP, about the same proportion as in France and Germany, and a lot smaller proportion than in Japan and Italy.

Meanwhile, foreign countries – especially rapidly expanding emerging Asian economies and oil-producing countries – are experiencing a savings glut. Individuals and central banks and other institutions, even from developing countries such as China with many poor people, have been pouring enormous sums of money into U.S. markets.

"The large inflows of foreign capital to the United States likely arise from the relatively more robust economic growth that occurred in the United States compared with almost any other area, the well-developed U.S. financial system, and the overall stability of the U.S. economy," the Congressional Research Service says.

According to CRS, foreign investors own about 10 percent of total U.S. publicly traded financial assets, including corporate stocks and bonds and marketable government securities. They also invest directly in U.S. business plant and equipment and in real estate.

In 2006 foreigners invested nearly $1.8 trillion in the U.S. economy, about $184 billion of that in direct investment and the rest in stocks and bonds. By different measures, the cumulative amount of foreign direct investment in the United States in 2005 came out somewhere between $1.6 trillion and $2.8 trillion.

"The United States is unique in that it is the largest foreign direct investor in the world and also the largest recipient of foreign direct investment," CRS says.

Some experts worry about the proportion of investment in the U.S. economy by foreign governments, about 16 percent of all foreign investment in 2005.

Foreign investors own more than half of all publicly traded U.S. Treasury securities. In 2006, Japan was the country having the largest holdings of long-term Treasury securities, about $644 billion, followed by China, about $350 billion.

Some U.S. industries and their representatives in Congress assert that East Asian central banks use their U.S. Treasury securities to manipulate foreign exchange rates to boost exports to the United States.

"At times, such acquisitions are used by foreign governments, either through coordinated actions or by themselves, to affect the foreign exchange price of the dollar," CRS says.

Some experts fear that any rapid sell-offs by foreign governments of their U.S. assets could trigger serious trouble for the world economy. Adversarial foreign governments could attempt to provoke a coordinated withdrawal from U.S. securities markets in order to destabilize the U.S. economy. Or foreign governments could decide to take their money elsewhere if their U.S. assets' value started to drop sharply.

In the meantime, all that foreign money flowing into U.S. markets has kept U.S. interest rates and prices lower than they would otherwise have been, fostering massive consumption of goods, including imports. Except for 1991, the U.S. current account deficit has risen steadily from about $12 billion in 1982 to $856.7 billion in 2006.

"The U.S. current account deficit is financed largely by China's current account surplus and growing investments by major oil exporters," a World Bank report says.

By the end of 2005, U.S. residents held about $9.6 trillion in foreign assets, while residents of foreign countries held about $12.5 trillion in U.S. assets. As a result, what is called the U.S. net international investment position reached a negative $2.8 trillion in 2005.

In 2006, for the first time since the net investment position turned negative in 1986, foreigners earned more income from their investments in the United States than U.S. investors earned on their assets abroad.

As the Council on Competitiveness sums up the situation: “To put it simply, foreign savings finance U.S. consumption, which drives foreign export-led growth. The situation is mutually beneficial in the short term but creates increasing risk of a global financial crisis.”

So what's next for the U.S. economy?

Share this page