5 THINGS YOU NEED TO KNOW ABOUT HOME PRICES

The Wall Street Journal | 2014-02-07 16:41

The S&P/Case-Shiller home price index showed that home prices have been on a tear during 2013, driven by more buyers chasing a shrinking supply of homes for sale — and critically, chasing fewer distressed properties. Those distressed properties tend to skew the index down as they account for a growing share of sales, and as the “mix” of sales tilts away from foreclosures and other distressed properties, the Case-Shiller index has shown unusually large price gains.

Tuesday’s report for November home prices showed that prices were 13.7% above their levels of a year earlier, the largest such gain in almost seven years. Here’s a breakdown of the report in five charts:

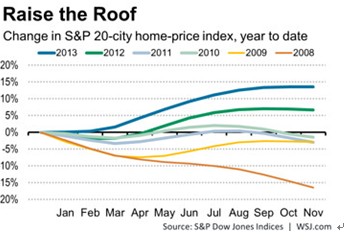

1.BEST YEAR SINCE THE BUBBLE

On a year-to-date basis, home prices through November have posted their best growth since 2005, which was the last full year of the housing bubble.

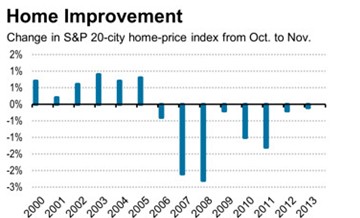

2.NOVEMBER IS ALWAYS SOFT

Even though home prices dropped by 0.1% from October on a nonseasonally adjusted basis, home prices can be softer in the winter months when there are fewer transactions. This is still the smallest drop over the last seven years in the nonseasonally adjusted index. (After adjusting for seasonal factors, home prices were up by 0.9%, according to the Case-Shiller index).

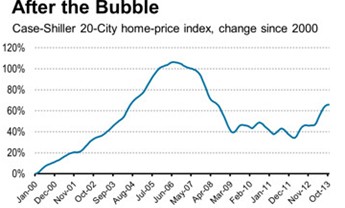

3.BIG REBOUND FROM BOTTOM

Prices in the 20-city index are now up nearly 24% since hitting a bottom in March 2012, a gain that few if anyone foresaw. Prices are still around 20% below the 2006 peak, compared to a peak-to-trough decline of 35% measured in March 2012.This price rebound off of the bottom is creating concerns about new bubbles in a number of markets among some analysts. A broader concern is that rising prices, while great for homeowners, will make it harder for the housing recovery to sustain itself because it will price more buyers out of the market.

4.WHIPLASH IN SOME MARKETS

Some housing markets are showing clear signs of whiplash, as the popping of housing bubbles triggered a rash of foreclosures. State efforts to stem those foreclosures, coupled with aggressive purchases by investors to acquire cheap homes that could be converted to rentals, have fueled a big rebound. Las Vegas, which was one of the most stable markets before last decade’s bubble, has been very volatile over the past decade:

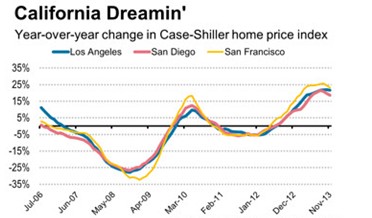

5.CALIFORNIA IS COOLING

California home prices have rallied over the past year, but the combination of higher mortgage rates and rising prices have dented affordability, and the rate of growth has cooled. Other home price indexes from Zillow Inc. and Black Knight Financial Services have shown a more pronounced slowdown.

Share this page