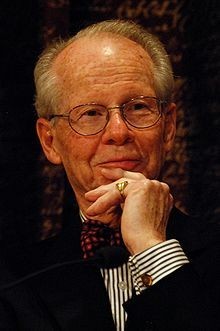

Oliver E. Williamson

USINFO | 2013-11-20 16:02

Nobel Memorial Prize in Economic Sciences (2009) Laureate

|

|

| Born |

September 27, 1932 (age 81) Superior, Wisconsin |

| Nationality | United States |

| Institution |

University of California, Berkeley Yale University University of Pennsylvania |

| Field | Microeconomics |

| Alma mater |

Carnegie-Mellon, (Ph.D. 1963) Stanford, (M.B.A. 1960) MIT, (B.Sc 1955) |

| Influences |

Chester Barnard Ronald Coase Richard Cyert Ian Roderick Macneil Herbert A. Simon John R. Commons |

| Influenced | Paul L. Joskow |

| Awards |

John von Neumann Award (1999) Nobel Memorial Prize in Economic Sciences (2009) |

Biography

A student of Ronald Coase, Herbert A. Simon and Richard Cyert, he specializes in transaction cost economics. Williamson received his B.S. in management from the MIT Sloan School of Management in 1955, M.B.A. from Stanford University in 1960, and his Ph.D. from Carnegie Mellon University in 1963. From 1965 to 1983 he was a professor at the University of Pennsylvania and from 1983 to 1988, Gordon B. Tweedy Professor of Economics of Law and Organization at Yale University. He has held professorships in business administration, economics, and law at the University of California, Berkeley since 1988 and is currently the Edgar F. Kaiser Professor Emeritus at the Haas School of Business. In 2009 he was awarded the Nobel Memorial Prize in Economics for "his analysis of economic governance, especially the boundaries of the firm", sharing it with Elinor Ostrom.

Theory

By drawing attention at high theoretical level to equivalences and differences between market and non-market decision-making, management and service provision, Williamson has been influential in the 1980s and 1990s debates on the boundaries between the public and private sectors.

His focus on the costs of transactions has led Williamson to distinguish between repeated case-by-case bargaining on the one hand and relationship-specific contracts on the other. For example, the repeated purchasing of coal from a spot market to meet the daily or weekly needs of an electric utility would represent case by case bargaining. But over time, the utility is likely to form ongoing relationships with a specific supplier, and the economics of the relationship-specific dealings will be importantly different, he has argued.

Other economists have tested Williamson's transaction-cost theories in empirical contexts. One important example is a paper by Paul L. Joskow, "Contract Duration and Relationship-Specific Investments: Empirical Evidence from Coal Markets," in American Economic Review, March 1987. The incomplete contracts approach to the theory of the firm and corporate finance is partly based on the work of Williamson and Coase.

Williamson is credited with the development of the term "information impactedness", which applies in situations where it is difficult to ascertain what the costs to information are. This condition exists "mainly because of uncertainty and opportunism, though bounded rationality is involved as well. It exists when true underlying circumstances relevant to the transaction, or related set of transactions, are known to one or more parties but cannot be costlessly discerned by or displayed for others."

—Markets and Hierarchies

Nobel Memorial Prize in Economic Sciences

In 2009, the Royal Swedish Academy of Sciences cited Williamson and Elinor Ostrom to share the 10-million Swedish kronor (£910,000; $1.44m) prize. They were awarded the "prize for their separate work in economic governance." Williamson, in the BBC's paraphrase of the academy's reasoning, "developed a theory where business firms served as structures for conflict resolution." He has argued that hierarchical organizations, such as companies, represent alternative governance structures, which differ in their approaches to resolving conflicts of interest.

Awards and fellowships

The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel, 2009

Distinguished Fellow, American Economic Association, 2007.

Horst Claus Recktenwald Prize in Economics, 2004.

Fellow, American Academy of Political and Social Science, 1997.

Member, National Academy of Sciences, 1994.

Fellow, American Academy of Arts and Sciences, 1983.

Fellow, Econometric Society, 1977.

Alexander Henderson Award, 1962.

Doctoris Honoris Causa in Economics, Université Paris-Dauphine, 2012.

Doctoris Honoris Causa in Economics, Nice University, 2005.

Doctoris Honoris Causa in Economics, University of Valencia, 2004.

Doctoris Honoris Causa in Economics, University of Chile, 2000.

Honorary Doctorate in Economics and Business Administration, Copenhagen Business School, 2000.

Doctoris Honoris Causa, Groupe HEC (Paris), 1997.

Doctoris Honoris Causa in Business Administration, St. Petersburg University, 1997.

Doctoris Honoris Causa in Economics, Turku School of Economics and Business Administration, 1995.

Doctoris Honoris Causa in Economic Science, Groningen University, 1989.

Doctoris Honoris Causa in Economic Science, University of St. Gallen, 1987

Oeconomiae Doctorem Honoris Causa, Ph.D., Norwegian School of Economics and Business Administration, Jubilee Celebration, 1986.

Share this page