Based on my research, I believe that ZST Digital Networks (ZSTN), ticker “ZSTN” on Nasdaq Global Market and referred to hereafter as ZSTN, provided false representation of its business relations and reported substantially exaggerated revenue and income to SEC.

1. ZSTN’s SEC filings report revenues hundreds of times of what it reported to the SAIC. The filings also show that it paid nearly zero tax in China, but reported substantial amounts to the SEC.

The first thing we check these days for a Chinese company is their annual report to State Administration of Industry and Commerce, or SAIC. Unlike what many Chinese small-cap stock promoters would like the investors to believe -- those Chinese companies only file SAIC reports for the purpose of maintaining business licenses and thus the data may not be accurate -- I argue that telling the truth is the default action a business takes if the purpose is just that simple.

I also argued in one of my previous articles discussing the red flags of CCME that the Chinese invoice system prevents a company from reporting significantly smaller revenue than what they actually achieve. If you do not think the IRS is stupid, you had better not believe that the Chinese Tax Authority is stupid either.

In the case of ZSTN, the case is even stronger because the operating company, Zhengzhou Shenyang Technology Company Limited (“Zhengzhou ZST”) is considered a foreign invested enterprise under PRC laws, and as a result, it is required to have an annual audit report sent to the local tax bureau and the local SAIC office (references here andhere). Consequently, we have a high confidence in the authenticity of the SAIC numbers.

The check turned out that ZSTN has reported not only exaggerated revenue numbers to SEC, but also SIGNIFICANTLY exaggerated ones.

The original SAIC files can be found here -- the original and annotated2009 SAIC Report, and the original and annotated 2008 SAIC report.

All these SAIC filings have precise matches with ZSTN’s SEC filings in terms of:

1) Name match: Zhengzhou Shenyang Technology Company Limited;

2) Legal Representative match: Zhong Bo;

3) Address match: Building 28, Huzhu Road, Zhongyuan District, Zhengzhou, China;

4) Owner match: Everfair Technologies Limited in Hong Kong.

So we can uniquely identify that those filings are truly the ones filed by the only direct subordinate of ZSTN.

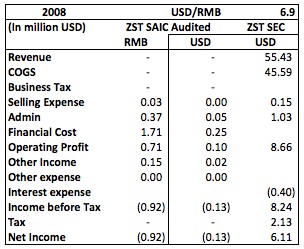

ZSTN reported $100m for 2009 revenue to SEC, but the audited SAIC file shows only a quarter million dollar in revenue, a drastic 400-fold difference. ZSTN reported a loss of $360k to SAIC, but a gain of $10m to SEC. In its SAIC filing to the China authority, ZSTN offered the reason for loss as “changing business”, and thus they “have low revenue, but high cost”.

ZSTN reported $55m for 2008 revenue to SEC, but the audited SAIC file surprisingly showed zero revenue for its core business. Its “other business income” totaled only up to around $20k, far less than what was reported to the SEC. ZSTN reported a loss of $130k to the SAIC, but reported a gain of more than $6m to SEC. In its SAIC filing, ZSTN reported the reason for loss as that “we just started business”.

What is also disturbing is that ZSTN claimed that it paid $2m and $4m tax in 2008 and 2009 respectively, but in reality it paid almost zero tax. Since the audit reports attached in the SAIC filings are the ones the Chinese tax authority used, I have to come to the conclusion that ZSTN misled the US investors and the SEC when they said that they paid millions of tax in China.

2. The management reported buying real estate for $7.8m when the market price indicates around $2.8m, which leads to the high likelihood of management embezzling investors’ money.

The company reported that it made two office space purchases in March 2010 and January 2011, respectively in the same building, but with vastly different average prices. In the first purchase, it paid $1.7m for 2,100 square meters, or RMB 5,500 per square meter, and it paid $7.8m for 2,880 square meters, or RMB 18,100 per square meter, only 9 months later. The second purchase was three times more expensive, which is extremely unusual anywhere, any time.

Steven Wegener found (.pdf) that the company paid $7.8m for the property which actually costs only $2.4-$3.0m.

Based on information provided by Steve Wegener in his blog, I was able to pinpoint the building in which the new purchases are located. The Chinese name is 国贸公馆, or Guo Mao Gong Guan (“GMGG”), which is identified by Soufun.com, the largest Chinese online real estate search engine, as a building with residential and retail spaces.

Soufun.com has a graph showing that the average sales price of GMGG started from RMB 4,300 in May 2009 and increased gradually to RMB 6,200 in September 2010.

The sales table also showed that the sales have stopped since September 2010. New sales will not begin until the next batch of construction is ready. The data also proves that the sales were for residential apartments that typically range from 50 to 100 square meters.

(Click to Enlarge)

Steven Wegener learned from the management that:

they were moving into the 3rd and 4th floors taking up retail space. They didn't know what they were going to do with the residential floors at the top of the building, maybe use as office space as the company grew.

The management’s actions are begging the following questions:

1. How did the company purchase two floors of the new building when GMGG was not selling the properties? Since sales do have to take effect after the real estate developer obtains sales license from the government and the sales have to be registered with the government, how can ZSTN purchase any properties in GMGG in December 2010 or January 2011?

2. How could ZSTN pay a price three times the market price? Given that the management may argue that retail space has a higher average price than residential space, I performed a search of a retail space of the same type three blocks away, which shows sales at an average price of $7,200 per square meter.

3. Why did ZSTN buy 2,100 square meters of residential space in its first purchase? Such a space would consist of at least 20 apartments, hardly of any use to an electronics business.

4. What kind of use is a retail space “purchased” in the second transaction for an electronics business, which should really use either office space or factories?

Based on this information, I doubt if ZSTN indeed purchased those properties as it claimed, especially the second purchase, and if it did, the purchases were not used as a means to embezzle the funds from the investors.

3. ZSTN was promoted by Westpark Capital, which has recently seen all its other promoted Chinese RTO companies halted by the SEC or exchange.

In late March and early April, exchange officials halted the trading of four Chinese companies brought public by WestPark Capital: consumer-electronics maker NIVS IntelliMedia (NIV), China Intelligent Lighting and Electronics (CIL), China Century Dragon Media (CDM), a television advertising producer, and China Electric Motor (CELM), a micro motor manufacturer.

These events were well summarized in a news piece by Scott Eden, a prolific reporter with TheStreet.com who has been focusing on the Chinese RTO issues.

The only other Chinese RTO company involved with Westpark Capital but yet to be exposed is ZSTN.

Westpark Capital was deeply involved in ZSTN’s public offering process. The original shell used to merge with ZSTN, SRKP 18, was set up by Richard Rappaport and Anthony Pintsopoulos, CEO and CFO of Westpark Capital, in January 2007.

Westpark, partnered with Rodman and Ranshaw, helped ZSTN to raise $5m and $25m in May 2009 and October 2009, respectively.

Conclusion

Overall, the following issues have been found:

1. ZSTN’s SEC filings report revenues hundreds of times of what it reported to the SAIC. The filings also show that it paid nearly zero tax in China but reported substantial amounts to the SEC.

2. The management reported buying real estate for $7.8m when the market price indicates around $2.8m, which leads to the high likelihood of management embezzling investors’ money.

3. ZSTN lied about its business relations and market share in the Henan IPTV and GPS market.

4. ZSTN was promoted by Westpark Capital, which has recently seen all its other promoted Chinese RTO companies halted by SEC or exchange.

Steven Wegener calculated that ZSTN had about $2.60 per share in cash. But since the management cannot be trusted and the true ZSTN may be non-existent/unprofitable, he believed that the stock could trade as low as $1. I agree with that judgment -- the fraudsters in the RTO frauds are unlikely to leave investors anything other than worthless papers.