Jensen's alpha

INVESTOPEDIA | 2014-06-05 17:17

In finance, Jensen's alpha (or Jensen's Performance Index, ex-post alpha) is used to determine the abnormal return of a security or portfolio of securities over the theoretical expected return.

The security could be any asset, such as stocks, bonds, or derivatives. The theoretical return is predicted by a market model, most commonly the capital asset pricing model (CAPM). The market model uses statistical methods to predict the appropriate risk-adjusted return of an asset. The CAPM for instance uses beta as a multiplier.

Calculation

In the context of CAPM, calculating alpha requires the following inputs:

• the realized return (on the portfolio),

• the market return,

• the risk-free rate of return, and

• the beta of the portfolio.

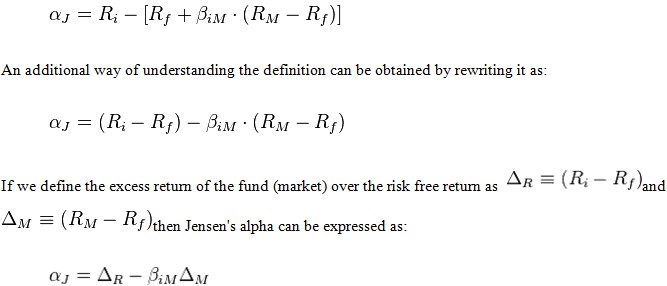

Jensen's alpha = Portfolio Return − [Risk Free Rate + Portfolio Beta * (Market Return − Risk Free Rate)]

Share this page