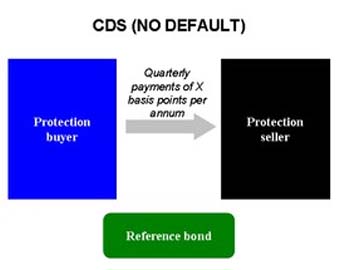

If the reference bond performs without default, the protection buyer pays quarterly payments to the seller until maturity If the reference bond defaults, the protection seller pays par value of the bond to the buyer, and the buyer transfers ownership of t

full story >>Quantitative easing (QE) is an unconventional monetary policy used by central banks to stimulate the economy when standard monetary policy has become ineffective.[1][2][3] A central bank implements quantitative easing by buying specified amounts of long t

Continue reading >>A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold.

Continue reading >>The foreign exchange market (forex, FX, or currency market) is a global decentralized market for the trading of currencies. The main participants in this market are the larger international banks.

Continue reading >>A fixed exchange rate, sometimes called a pegged exchange rate, is also referred to as the Tag of particular Rate, which is a type of exchange rate regime where a currency's value is fixed against the value of another single currency, to a basket of other

Continue reading >>The Federal Reserve System (also known as the Federal Reserve, and informally as the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, largely in response to a seri

Continue reading >>