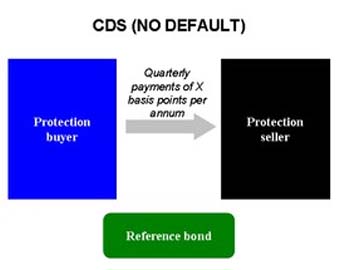

If the reference bond performs without default, the protection buyer pays quarterly payments to the seller until maturity If the reference bond defaults, the protection seller pays par value of the bond to the buyer, and the buyer transfers ownership of t

full story >>Quantitative easing (QE) is an unconventional monetary policy used by central banks to stimulate the economy when standard monetary policy has become ineffective.[1][2][3] A central bank implements quantitative easing by buying specified amounts of long t

Continue reading >>In the modern world, most of the world's currencies are floating; such currencies include the most widely traded currencies: the United States dollar, the euro, the Norwegian krone, the Japanese yen, the British pound, the Swiss franc, and the Australian

Continue reading >>Generally used to describe when something is selling below its normal price. An asset or fund is described as being at discount when its value is above its market price. In the money markets it is the action of buying financial paper at less than par valu

Continue reading >>Two or more countries agreeing to keep their currencies at a same exchange rate relative to one another, but not relative to other countries. The countries involved in a joint float agreement form a sort of partnership where their currencies move jointly.

Continue reading >>The difference between the higher price paid for a fixed-income security and the security's face amount at issue.

Continue reading >>