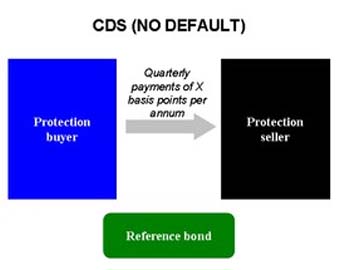

If the reference bond performs without default, the protection buyer pays quarterly payments to the seller until maturity If the reference bond defaults, the protection seller pays par value of the bond to the buyer, and the buyer transfers ownership of t

full story >>Quantitative easing (QE) is an unconventional monetary policy used by central banks to stimulate the economy when standard monetary policy has become ineffective.[1][2][3] A central bank implements quantitative easing by buying specified amounts of long t

Continue reading >>The Santiago Principles are a set of 24 voluntary guidelines that assign "best practices" for the operations of Sovereign Wealth Funds (SWFs). The principles were proposed in 2008 through a joint effort between the International Monetary Fund (IMF) and th

Continue reading >>The S&P 500, or the Standard & Poor's 500, is a stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ.

Continue reading >>Risk premium is the minimum amount of money by which the expected return on a risky asset must exceed the known return on a risk-free asset, or the expected return on a less risky asset, in order to induce an individual to hold the risky asset rather than

Continue reading >>Return on investment (ROI) is the concept of an investment of some resource yielding a benefit to the investor. A high ROI means the investment gains compare favorably to investment cost. As a performance measure, ROI is used to evaluate the efficiency of

Continue reading >>