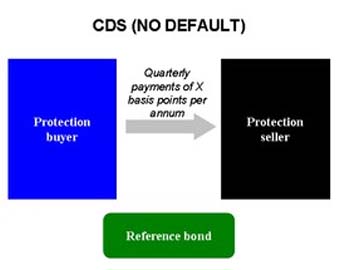

If the reference bond performs without default, the protection buyer pays quarterly payments to the seller until maturity If the reference bond defaults, the protection seller pays par value of the bond to the buyer, and the buyer transfers ownership of t

full story >>Quantitative easing (QE) is an unconventional monetary policy used by central banks to stimulate the economy when standard monetary policy has become ineffective.[1][2][3] A central bank implements quantitative easing by buying specified amounts of long t

Continue reading >>A corporate bond is a bond issued by a corporation. It is a bond that a corporation issues to raise money effectively in order to expand its business.[1] The term is usually applied to longer-term debt instruments, generally with a maturity date falling a

Continue reading >>In finance, a contract for difference (or CFD) is a contract between two parties, typically described as "buyer" and "seller", stipulating that the seller will pay to the buyer the difference between the current value of an asset and its value at contract

Continue reading >>"Closing price" generally refers to the last price at which a stock trades during a regular trading session. For many U.S. markets, regular trading sessions run from 9:30 a.m. to 4:00 p.m. Eastern Time.

Continue reading >>Chubb Corporation is the eighth largest property and casualty insurer in the United States, with over 120 offices located in 29 countries, and offers commercial, specialty, surety, and personal insurance services. As of 2008, the corporation is the 180th

Continue reading >>