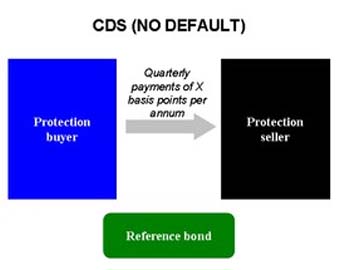

If the reference bond performs without default, the protection buyer pays quarterly payments to the seller until maturity If the reference bond defaults, the protection seller pays par value of the bond to the buyer, and the buyer transfers ownership of t

full story >>Quantitative easing (QE) is an unconventional monetary policy used by central banks to stimulate the economy when standard monetary policy has become ineffective.[1][2][3] A central bank implements quantitative easing by buying specified amounts of long t

Continue reading >>A sovereign wealth fund (SWF) is a state-owned investment fund investing in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity fund or hedge funds. Sovereign wealth funds inv

Continue reading >>A sovereign default is the failure or refusal of the government of a sovereign state to pay back its debt in full. It may be accompanied by a formal declaration of a government not to pay (repudiation) or only partially pay its debts (due receivables), or

Continue reading >>Settlement of securities is a business process whereby securities or interests in securities are delivered, usually against (in simultaneous exchange for) payment of money, to fulfill contractual obligations, such as those arising under securities trades.

Continue reading >>A Segregated Fund or Seg Fund is a type of investment fund administered by Canadian insurance companies in the form of individual, variable life insurance contracts offering certain guarantees to the policyholder such as reimbursement of capital upon deat

Continue reading >>