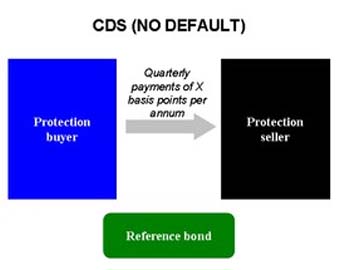

If the reference bond performs without default, the protection buyer pays quarterly payments to the seller until maturity If the reference bond defaults, the protection seller pays par value of the bond to the buyer, and the buyer transfers ownership of t

full story >>Quantitative easing (QE) is an unconventional monetary policy used by central banks to stimulate the economy when standard monetary policy has become ineffective.[1][2][3] A central bank implements quantitative easing by buying specified amounts of long t

Continue reading >>The Federal Open Market Committee (FOMC), a committee within the Federal Reserve System (the Fed), is charged under United States law with overseeing the nation's open market operations (i.e., the Fed's buying and selling of United States Treasury securit

Continue reading >>Earnings per share (EPS) is the dollar value of earnings per each outstanding share of a company's common stock.

Continue reading >>A derivative is a financial contract which derives its value from the performance of another entity such as an asset, index, or interest rate, called the "underlying

Continue reading >>Credit brisk refers to the risk that a borrower will default on any type of debt by failing to make payments which it is obligated to do.[1] The risk is primarily that of the lender and include lost principal and interest, disruption to cash flows, and in

Continue reading >>